Gift Tax 2024 Calculator Usa

Gift Tax 2024 Calculator Usa. The 2024 gift tax limit is $18,000, up from $17,000 in 2023. Here's how the gift tax works, along with current rates and exemption amounts.

The gift tax limit (also known as the gift tax exclusion) increased to $18,000 this year, up from $17,000 in 2023. In 2023, the annual gift tax “exclusion amount” is $17,000 per person.

Gift Tax 2024 Calculator Usa Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

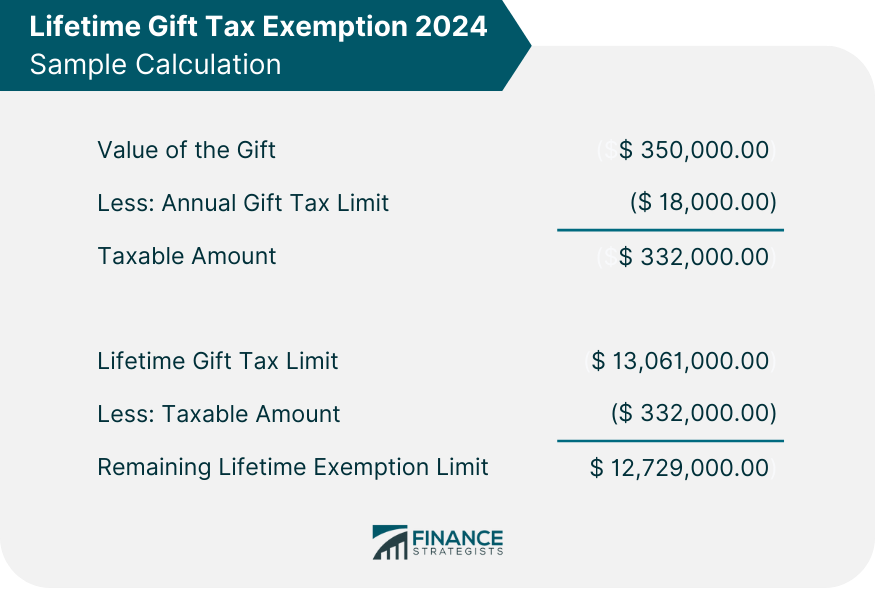

Gift Tax Limit 2024 Calculation, Filing, and How to Avoid Gift Tax, The lifetime limit for gifting is.

Source: www.financestrategists.com

Source: www.financestrategists.com

Gift Tax Limit 2024 Calculation, Filing, and How to Avoid Gift Tax, 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000.

Source: eztax.in

Source: eztax.in

Gift Tax Calculator EZTax®, Gift tax is a federal tax on any gifts you give during the year that are worth more than the annual gift tax exclusion, which is $18,000 for gifts given in 2024 (the.

Source: cwccareers.in

Source: cwccareers.in

Gift Tax Limit 2024 Exemptions, Gift Tax Rates & Limits Explained, This gift tax calculator can help you determine whether you might owe gift tax this year, and understand how it works.

Source: www.carboncollective.co

Source: www.carboncollective.co

Gift Tax Limit 2023 Explanation, Exemptions, Calculation, How to Avoid It, Enter any gifts given before the tax year.

Source: charleanwgerry.pages.dev

Source: charleanwgerry.pages.dev

Annual Gift Tax Exclusion 2024 Golda Gloriane, 1 for 2024, the limit has been adjusted for inflation and will rise to $18,000.

Source: www.zrivo.com

Source: www.zrivo.com

Gift Tax Rate 2023 2024 What Is It And Who Pays?, The gift tax limit (also known as the gift tax exclusion) increased to $18,000 this year, up from $17,000 in 2023.

Source: www.expatustax.com

Source: www.expatustax.com

Gift Tax rules for US citizens (Guidelines) Expat US Tax, The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return.

Source: zsazsawfayina.pages.dev

Source: zsazsawfayina.pages.dev

Irs Gift Limits 2024 Kayle Eleanora, The gift tax is a federal tax imposed on individuals who give valuable gifts to others.

Source: www.zelllaw.com

Source: www.zelllaw.com

What will the estate and gift tax exclusions be in 2024, 2025?, Someone with three children can gift as much as $18,000 per child for a total of $54,000, without needing to pay a gift tax for the year.

Category: 2024